24

Years of

.Net and Azure Competency

30+

Successfully

Delivered

Projects

10+

Country Client Base - Across the US, Asia, Europe, & Australia

7.5

Years

Average Client

Loyalty

AI Software Use Cases for Insurance

There’s a myriad of use cases of AI for the insurance industry, and BlastAsia can guide you in choosing and bringing to life any of these solutions

AI Underwriting Software

Have a software that uses AI in processing applicant records and lifestyle data to generate faster, more accurate underwriting decisions.

Virtual Insurance Assistants

Leverage AI chatbots that use NLP to answer queries, generate quotes, and assist in policy applications.

AI Fraud Detection Systems

Build a system with an AI that detects irregularities by identifying unusual behavior.

AI Customer Profiling Platforms

Easily segment customers based on data patterns using AI to offer personalized insurance packages.

Claims Automation Tools

Build a tool that uses AI that applies computer vision to verify damages and NLP to automate claim approvals.

AI Churn Prediction Software

Have a software that uses AI to forecast customer churn risk based on behavior, engagement, and transaction history.

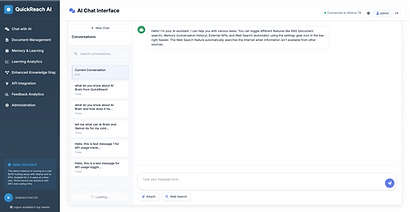

Our Tool of Choice for Private AI Implementation

QuickReach empowers you with custom enterprise AI solutions that uses your own private AI. Start with a private AI brain that securely holds all of your company information then add specialized AI assistants that perform specific tasks as you grow. Unlike cloud AI that forgets everything, your private AI learns and improves with every interaction, and you can have enterprise-level access control so you can control how information is shared within your organization.

Other Custom Insurance Software Solutions We Can Build

There are numerous custom software that can be built for the insurance industry, and our expert engineering teams can bring to life any of these for you

Claim Processing Solutions

BlastAsia builds claim processing systems that facilitate flexible customer engagement, automate damage assessments, reduce loss adjustment costs, and enhance settlement accuracy.

AI Customer Profiling Platforms

Build an Insurance Coverage Tracker App that helps users manage their insurance policies, monitor coverage details, and track renewal dates. This app ensures users stay organized and informed about their protection plans.

Underwriting Automation

We can build solutions that automate operations, including application processing, task management, and policy management. We integrate AI and data analytics to enable automated risk assessments and premium calculations.

Insurance Beneficiary Management App

Create an Insurance Beneficiary Management App that simplifies updating, managing, and tracking beneficiary information for policyholders. This app enhances transparency and ensures accurate record-keeping for insurance beneficiaries.

Insurance Marketplace

Build an Insurance Marketplace Platform that connects customers with a wide range of insurance providers, simplifying the comparison and purchase of policies. This software streamlines insurance shopping with user-friendly tools and tailored recommendations.

Insurance Literacy and Advisory App

Help educate users about insurance concepts, policy options, and best practices, empowering informed decision-making. This app combines guidance with tools to enhance financial security.

Our Tool of Choice

for Custom Software Development

Xamun seeks to revolutionize software development by leveraging the power of AI agents across the entire software development cycle. It augments the abilities of BlastAsia’s experts to deliver software at record speeds and unparalleled quality.

Insurance Industry Clients

BlastAsia has over 20 years in software product engineering expertise for global clients. We have the expertise to deliver insurance software for:

Life Insurance

Auto Insurance

Home Insurance

Pet Insurance

Accident Insurance

Liability Insurance

Health Insurance

Travel Insurance

Home Insurance

Disability Insurance

Term Life Insurance

Pension Plans

Previous Insurance Software Development Projects

As a software development company for the insurance industry, we have delivered custom solutions that are advanced and compliant

Cyberinsurance Platform

The project is a cyber-insurance solution that serves as a platform to manage policies - covering the whole lifecycle from submission of applications to management of endorsements, renewals, cancellations and claims.

Insurance Tech Software

BlastAsia worked with a US insurance company to build software for their collections insurance. The client's property policies protect valuable items like art and antiques. Insuring these collections involves difficult calculations and sensitive data. To avoid big losses, BlastAsia's team worked closely with the client to create a solid, well-designed system.

E-commerce Platform for Microinsurance

BlastAsia developed an e-commerce marketplace with back-end functionalities for a startup offering microinsurance to millennials, providing insurance companies an automated platform to deliver a frictionless customer experience and streamline their own processes, from paperless sales and claims to data-driven product improvements.

PDF-Editing iPad App for Financial Advisors

The client for the project is a South African company that developed a platform for independent financial advisors for day-to-day client management, practice management, financial planning, and compliance management. To help the users further, BlastAsia built a PDF- editing tool that can be used to download documents from the web app, and open, edit, and sync PDF files.

Plug-in Chatbot Prototype for a Data-Driven Financial Advisory Platform

BlastAsia developed a chatbot/robo-advisor prototype using Microsoft Bot Framework and Azure services, including a database, natural language understanding, and Q&A capabilities, to provide on-demand personal financial advisory services and recommendations through a free, 24/7 Facebook Messenger interface.

AI/Cognitive-Powered Form Reader for a Process Automation /Workflow Automation Platform

BlastAsia developed a chatbot/robo-advisor prototype using Microsoft Bot Framework and Azure services, including a database, natural language understanding, and Q&A capabilities, to provide on-demand personal financial advisory services and recommendations through a free, 24/7 Facebook Messenger interface.

Rostering Platform

The client provides a time and attendance platform with roster software enabling real-time notifications, availability checks, and timesheet exports, while BlastAsia developed the platform and a security guard management app spinoff.